Exploring Options: Can Former Bankrupts Secure Credit Rating Cards Adhering To Discharge?

Browsing the monetary landscape post-bankruptcy can be an overwhelming job for individuals looking to restore their debt. One usual inquiry that arises is whether previous bankrupts can effectively acquire charge card after their discharge. The response to this questions involves a diverse exploration of different variables, from charge card alternatives tailored to this group to the impact of previous economic decisions on future creditworthiness. By comprehending the intricacies of this procedure, individuals can make informed decisions that might pave the method for an extra safe and secure financial future.

Understanding Bank Card Options

When taking into consideration credit score cards post-bankruptcy, individuals need to carefully examine their needs and monetary scenario to select the most appropriate alternative. Safe credit rating cards, for instance, call for a cash down payment as security, making them a viable option for those looking to restore their credit scores history.

Additionally, people need to pay very close attention to the interest rate (APR), elegance period, annual costs, and benefits programs used by various charge card. APR dictates the cost of borrowing if the balance is not paid in complete every month, while the elegance period figures out the window throughout which one can pay the balance without incurring rate of interest. Additionally, yearly costs can affect the general expense of owning a charge card, so it is important to assess whether the benefits outweigh the fees. By adequately evaluating these elements, people can make educated choices when choosing a bank card that aligns with their monetary goals and scenarios.

Aspects Influencing Authorization

When getting debt cards post-bankruptcy, recognizing the factors that influence approval is important for individuals seeking to rebuild their economic standing. One important factor is the candidate's credit history. Adhering to an insolvency, credit report typically take a hit, making it harder to get typical credit rating cards. However, some providers use protected charge card that require a down payment, which can be a much more achievable option post-bankruptcy. An additional considerable element is the applicant's revenue and employment condition. Lenders intend to make certain that individuals have a secure income to make prompt payments. Additionally, the size of time since the personal bankruptcy discharge contributes in authorization. The longer the period given that the bankruptcy, the greater the opportunities of approval. Demonstrating responsible economic behavior post-bankruptcy, such as paying costs promptly and keeping credit rating usage low, can likewise positively affect charge card approval. Comprehending these aspects and taking actions to improve them can boost the probability of safeguarding a credit report card post-bankruptcy.

Guaranteed Vs. Unsecured Cards

Secured credit score cards call for a cash down payment as security, usually equivalent to the credit scores restriction expanded by the issuer. These cards commonly provide greater credit history restrictions and lower rate of interest prices for people with excellent credit report ratings. Inevitably, the option between safeguarded and unsafe debt cards depends on the individual's economic situation and credit report goals.

Structure Credit Score Properly

To properly restore credit score post-bankruptcy, developing a pattern of accountable credit history use is necessary. Furthermore, keeping credit rating card equilibriums low loved one to the debt limitation can positively impact credit rating scores.

One more approach for building credit properly is to check This Site credit rating reports consistently. By reviewing credit scores reports for mistakes or indicators of identity theft, individuals can deal with problems quickly and preserve the accuracy of their credit report history.

Enjoying Long-Term Perks

Having actually established a foundation of responsible credit monitoring post-bankruptcy, people can now concentrate on leveraging their boosted credit reliability for long-lasting financial advantages. By constantly making on-time repayments, keeping debt application reduced, and monitoring their credit rating records for accuracy, previous bankrupts can slowly rebuild their credit report. As their credit history raise, they might become qualified for much better charge card offers with reduced interest prices and higher credit restrictions.

Gaining lasting benefits from enhanced credit reliability prolongs past just debt cards. Additionally, a favorable credit history account can enhance work prospects, as some employers may inspect credit score reports as part of the hiring process.

Verdict

In conclusion, former insolvent individuals might have trouble safeguarding credit report cards adhering to discharge, but there are choices offered to assist reconstruct credit. Understanding the different sorts of charge card, variables influencing authorization, and the relevance of responsible charge card usage can assist individuals in this situation. By choosing the best card and using it properly, former bankrupts can slowly enhance their credit report rating and gain the long-term advantages of having visit this website accessibility to credit.

Showing responsible financial behavior post-bankruptcy, such as paying bills on time and keeping credit scores usage low, can also positively affect credit report card authorization. Furthermore, keeping credit report card equilibriums low relative to the credit history limit can positively impact credit report scores. By constantly making on-time repayments, keeping debt application reduced, and checking their credit score records for accuracy, previous bankrupts can slowly rebuild their credit scores. As their credit rating ratings visit this site right here enhance, they might end up being eligible for far better credit card supplies with reduced interest prices and greater credit score restrictions.

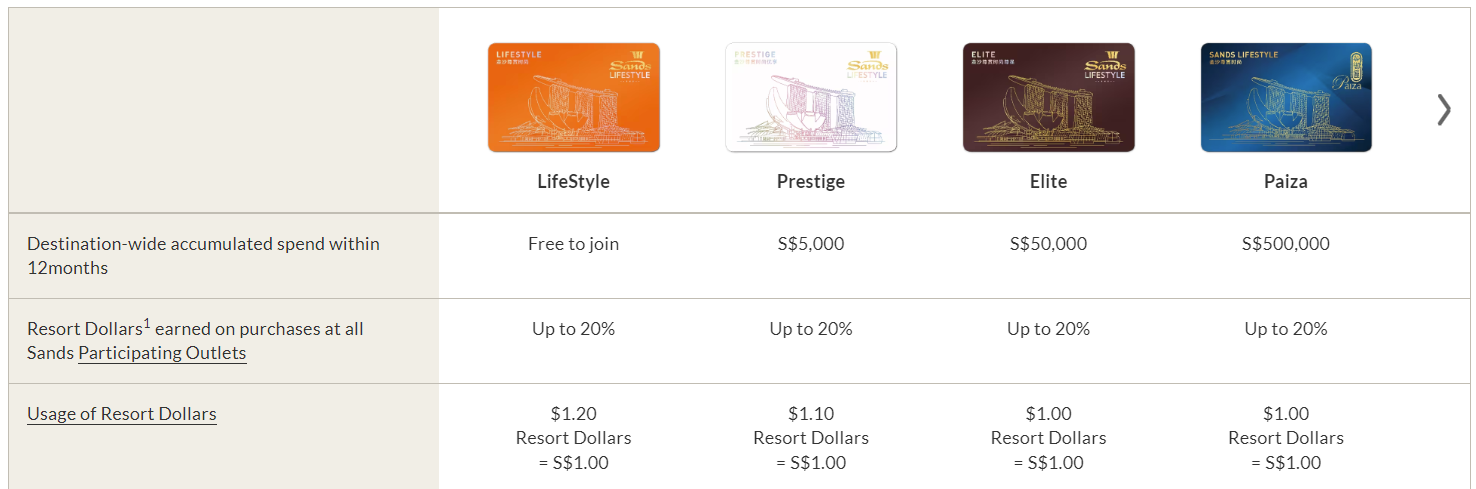

Recognizing the different types of debt cards, factors impacting approval, and the relevance of accountable credit score card usage can aid people in this circumstance. secured credit card singapore.